Summer 2022

News You Can Use

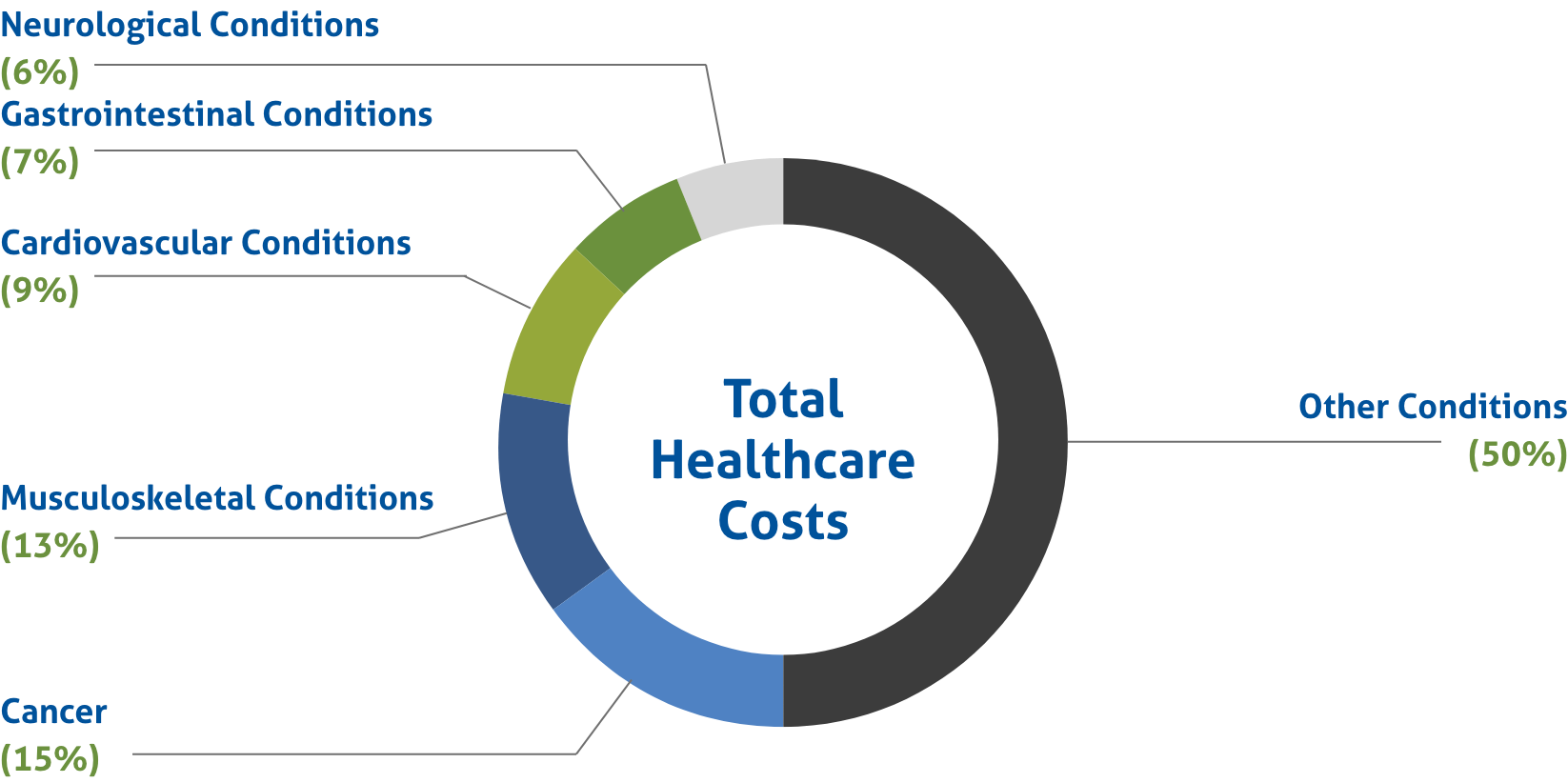

Five Conditions Total 50% of Healthcare Costs

A recent study1 by the Health Action Council (HAC) and UnitedHealthcare (UHC) found that just five conditions make up 50% of healthcare spending. The national data analyzed came from more than 320,000 covered lives from employers under HAC’s membership across the country. Data was analyzed from July 2018 - June 2021.

Total Costs |

Total Claims |

Primary Cost Associated |

|

|---|---|---|---|

1. Cancer |

$533 million |

103,000 |

chemotherapy |

2. Musculoskeletal Conditions |

$477 million |

317,000 |

knee osteoarthritis |

3. Cardiovascular Conditions |

$357 million |

169,000 |

abnormal heart rhythms |

4. Gastrointestinal Conditions |

$284 million |

136,000 |

immunosuppressive drugs |

5. Neurological Conditions |

$225 million |

240,000 |

multiple sclerosis medications |

What This Means

The results of the study highlight the clear importance for employers to have partners with two distinct strong suits (claims management programs and the right PBM partners).

A strong claim management program, specifically for cancer care, can help alleviate costs in the present and down the road. These programs help with treatment from start to finish – getting members the care they need when they need it.

The right PBM partners will help self-funded employers save on their employees’ prescription medications. With cancer as the main cost driver and two of the other top five primary costs having to do with expensive medication, PBM partners play a major role in protecting an organization’s bottom line.

No Surprises Act (NSA) & Transparency in Coverage Rule (TiC) Updates

National

Department of Labor officials will be looking for “ghost contracting” in health plans’ machine-readable files (MRFs). Ghost contracting is a term used to describe the practice of a plan including contract rates for services that providers never provide. MRFs are to be publicly posted by health plans by July 1, as required by the TiC.

More on Ghost ContractingColorado

The Colorado House of Representatives recently passed a bill banning medical debt collection without price transparency. HB1285 bans hospitals from pursuing debt collections against patients if said hospital is not in compliance with the new transparency requirements from the NSA and TiC. Moreover, the bill prohibits noncompliant hospitals from filing negative credit reports or obtaining state court judgements for any outstanding debts.

More on CO HB1285Texas

The U.S. Department of Health and Human Services (HHS) expects to publish the final regulation on the Independent Dispute Resolution (IDR) in early summer. In early May, a court granted the HHS’ request to pause the Texas appeal while the federal government works on the final rule. HHS’ Secretary Xavier Becerra attributes the delay to the lawsuits filed earlier in the year.

More on IDRWashington State Partnership Access Lines Program (WAPAL)

In the State of Washington, health insurance carriers, self-funded multiple employer welfare arrangements (MEWAs) and employers that provide healthcare to residents of Washington through a self-funded or level funded plan are required to report and pay a quarterly assessment to fund the WAPAL. For Fiscal Year 2022, the fee was reduced to $0.07 (from $0.13) per covered life per month.

At TPSC, we make it easy for our clients to remain compliant with these regulations. We provide quarterly enrollment figures upon request. Once they are requested the first time, they will automatically be provided moving forward. Initially, employers will need to register with the WAPAL Fund Online Assessment System and request quarterly enrollment figures from TPSC. Every quarter thereafter, the figures will be provided automatically, allowing employers to simply file the Covered Lives Report and pay the quarterly assessment.

Please contact your TPSC Account Manager if you have any questions regarding the WAPAL.

PCORI Filing Due Date Approaching

Patient-Centered Outcomes Research Institute (PCORI) Fees will be due on July 31, 2022. Employers who sponsor self-insured plans subject to the PCORI fee are responsible for completing and filing Form 720, as required by the IRS.

Plan End Date |

Filing Deadline |

Applicable Rate |

|---|---|---|

January 2021 - September 2021 |

July 31, 2022 |

$2.66 |

October 2021 - December 2021 |

July 31, 2022 |

$2.79 |

For plans ending in January to September of 2021, the fee is $2.66 (multiplied by the average number of lives covered under the policy). For plans ending in October to December of 2021, the fee is $2.79 (multiplied by the average number of lives covered under the policy).

IRS PCORI Filing ChartPlan Limits for 2023 Announced

ACA Compliant Plans – Maximum Annual Out-of-Pocket Limit |

||

|---|---|---|

2022 |

2023 |

|

Self-only Coverage |

$8,700 |

$9,100 |

Family Coverage |

$17,400 |

$18,200 |

HDHP – Minimum Annual Deductible |

||

|---|---|---|

2022 |

2023 |

|

Self-only Coverage |

$1,400 |

$1,500 |

Family Coverage |

$2,800 |

$3,000 |

HDHP – Maximum Annual Out-of-Pocket Limit |

||

|---|---|---|

2022 |

2023 |

|

Self-only Coverage |

$7,050 |

$7,500 |

Family Coverage |

$14,100 |

$15,000 |

HSA – Annual Contribution Limit |

||

|---|---|---|

2022 |

2023 |

|

Self-only Coverage |

$3,650 |

$3,850 |

Family Coverage |

$7,300 |

$7,750 |

Catch-Up Contribution |

$1,000 |

$1,000 |

HDHP – Maximum Annual Out-of-Pocket Limit |

||

|---|---|---|

2022 |

2023 |

|

$1,800 |

$1,950 |

|