Self-funding is no longer only advantageous to large employer groups — small to midsize companies can benefit from it too.

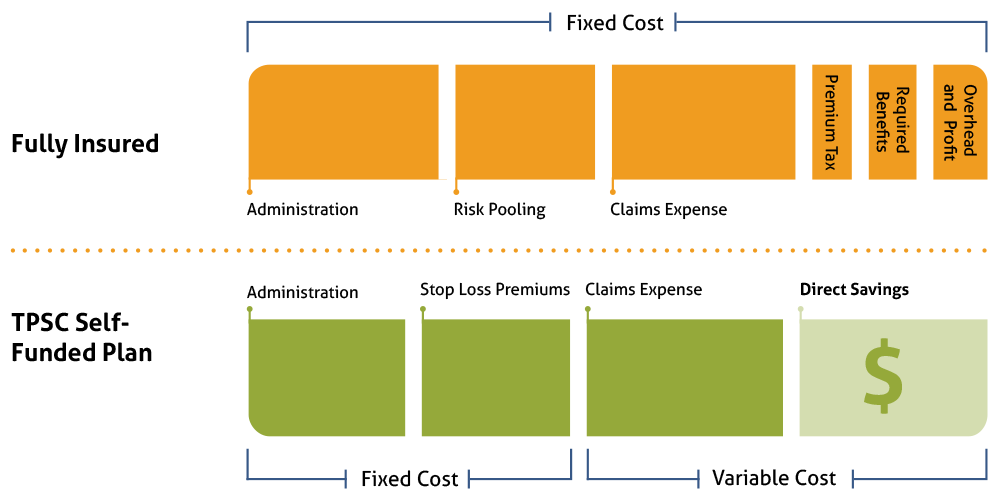

Rising healthcare premiums and industry requirements have made finding cost-effective healthcare benefits paramount for employers. In the past, fully insured plans were considered a primary choice for small to midsize companies because of their fixed costs. With this model, it does not matter how many claims an employer does or does not incur, the same monthly cost must be paid to the insurer.

On the other hand, with a self-funded plan, the employer pays claims costs only as they are incurred. The employer reaps the savings in the years with average to below average claims. In the years with above average claims, the employer can be protected with stop-loss insurance to limit their liability to a comparable fully insured amount.

However, with self-funded plans, a larger percentage of the employer’s dollar can be expended towards the cost of claims, the variable cost or result in direct savings.

Did you know?

It is estimated that over 100 million employees receive benefits from a self-funded program.

The Benefits of Self-Funding Include:

- Elimination of state premium tax

- Low administrative and operating costs

- Effective claim management

- Improved cash flow

- Transparent reporting for all stakeholders

- Customized plan design

- Elimination of carrier profit margin

- Stop-loss protection against large claims