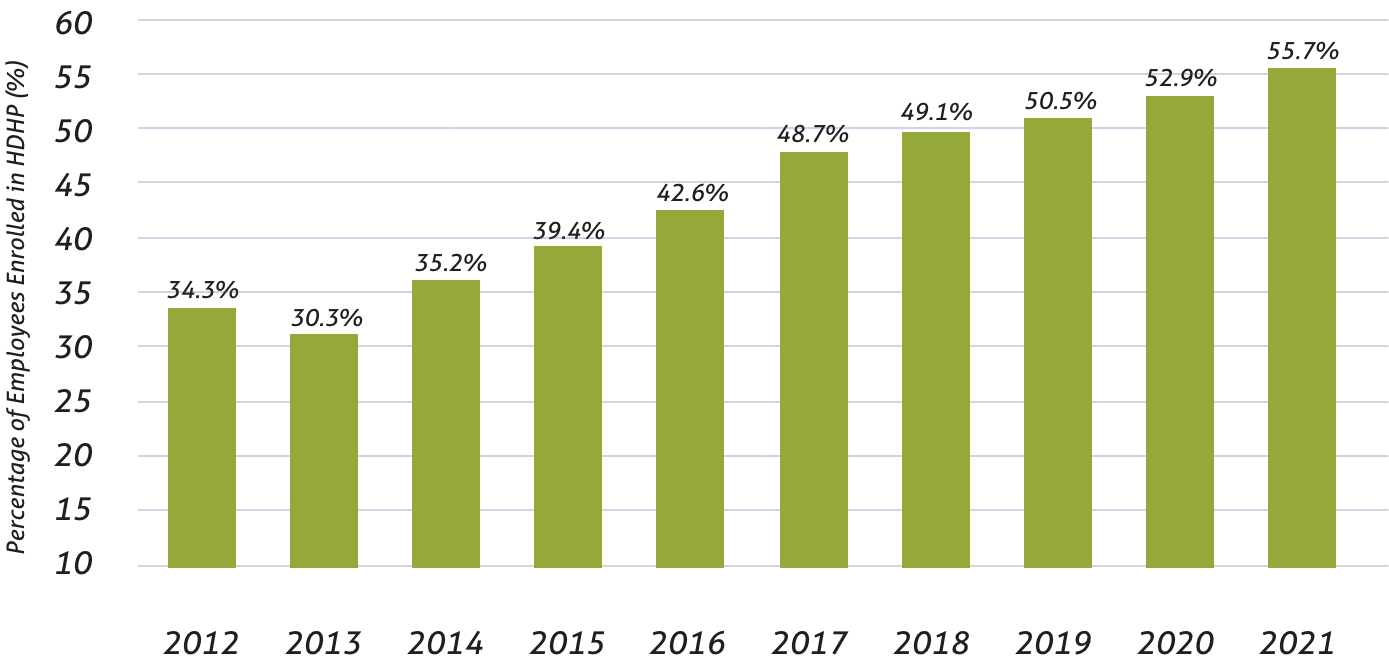

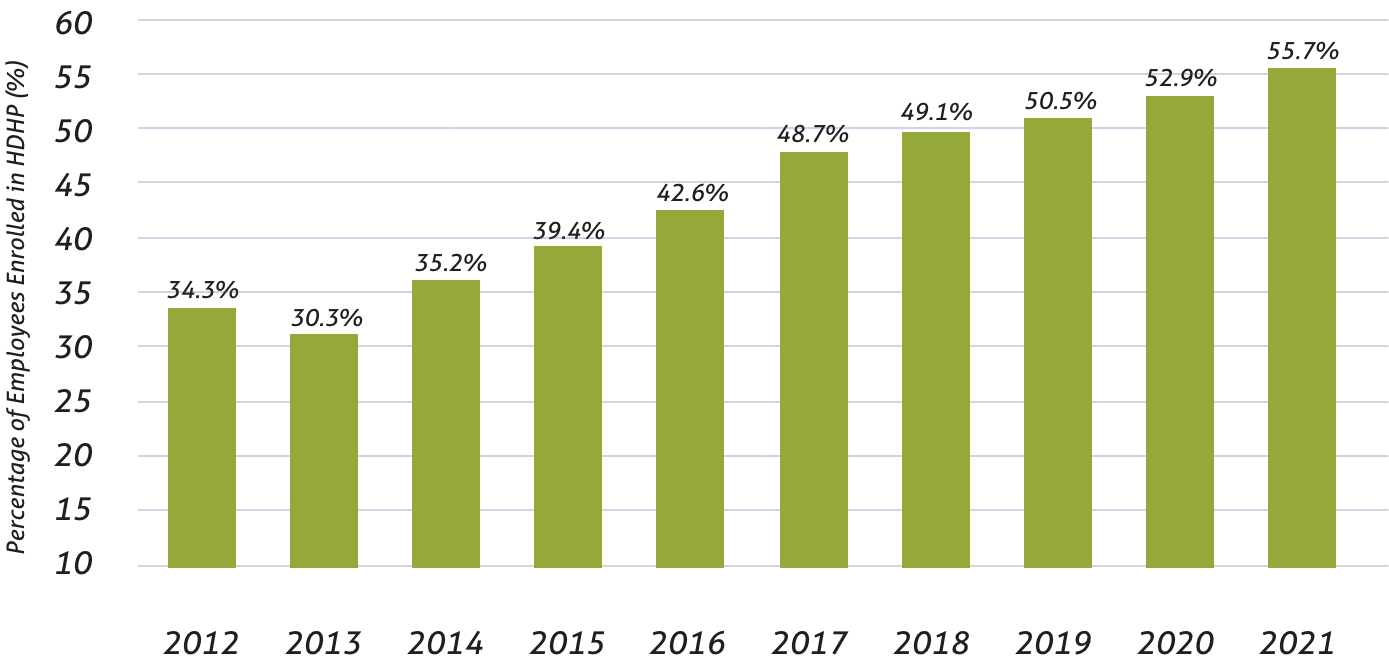

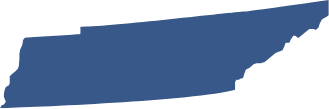

HDHP Enrollment Hits All Time High in 2021

A recent study* shows that High Deductible Health Plan (HDHP) enrollment reached an all-time high in 2021, with over 60% of private-sector workers covered under the plan in some US states. Low monthly premiums highlight HDHP’s desirability. Rates of enrollment continue to climb as employers expand HDHP offerings to include Health Savings Accounts (HSA), a service that TPSC proudly provides.

Maine (76.2%)

Tennessee (68.7%)

Nebraska (67.6%)

Hawaii (11.6%)

District of Columbia (28.4%)

Alaska (42.4%)

* https://www.valuepenguin.com/high-deductible-health-plan-study

Employers of all sizes see value in HDHP and are learning new ways of supporting employee needs through additional resources. Perhaps one of the most supported methods is the use of HSAs.

1

Nine out of ten employers believed that offering HSA contributions will improve HDHP utilization.

Employer percentage of those who support: 90%

Employer percentage of those who implement: >80%

2

Investment options within Health Savings Accounts are the most implemented practice.

84% of employers offer Investment options for HSAs

TPSC’s HSA Options3

Employers agree that more education is needed to help inform employees of their HSA utilization options. While 98% of employers hold this viewpoint, only 70% are actively implementing educational resources.

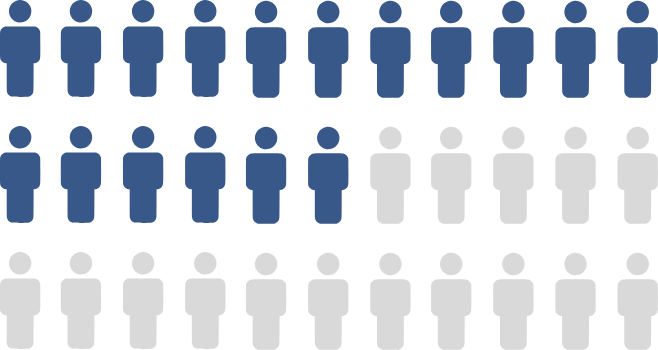

17 out of 33 employers

place ongoing education in the top

3 recommended HDHP practices

4

In an attempt to improve drug price transparency, employers recommend real-time pharmacy tools.

Employer percentage of those who support: 98%

Employer percentage of those who implement: 46%

5

Employers can encourage employees to use preventative care services by covering medications’ pre-deductible costs.

Employer percentage of those who support: 96%

Employer percentage of those who implement: < 75%

6

Employers agreed that offering price transparency tools would be a great benefit to workers. Through these tools, employees can estimate care costs.

Employer percentage of those who support: 94%

Employer percentage of those who implement: 66.6%

* https://healthpayerintelligence.com/news/9-employer-best-practices-for-high-deductible-health-plan-design

A new deadline will be set for the reporting rule outlined in a 2021 report entitled “Reporting Requirements Regarding Air Ambulance Services, Agent and Broker Disclosures, and Provider Enforcement.” The original deadline was set to be in March of 2023.

Anne Lenna, SPCA President, connected with a CMS official about when the reporting rule will go into effect. At this time, the deadline will be delayed, and new information will be shared when available.

December 2020 saw the Consolidated Appropriations Act passed into law by Congress. The bill addresses how well employer plan sponsors and Health Insurance Carriers are handling compliance requirements under the Mental Health Parity and Addiction Equity Act (MHPAEA). Requirements include a detailed analysis of each plan sponsor’s plan.

With TPSC, Self Insured Reporting (SIR) can complete the analysis to keep your group compliant. TPSC can assist in coordinating the analysis by SIR for your group. Reach out to your dedicated account manager to learn more!